Last month, we learned there were on-again, off-again talks for Disney to purchase 21st Century Fox. Then Comcast became a suitor, dropped out, and now it looks like Disney has emerged as the corporate behemoth that will become even larger due to the acquisitions. Variety reports that The Walt Disney Company has “set a $52.4 billion, all-stock deal to acquire 20th Century Fox and other entertainment and sports assets from Rupert Murdoch’s empire.” Disney chairman-CEO Bob Iger has extended his contract to the end of 2021 to oversee the transition. Disney expects regulatory review of acquisition to take about 18 months.

Since Disney can’t double up on certain entities, “21st Century Fox will spinoff Fox Broadcasting Co., Fox Sports, Fox News, Fox Television Stations and a handful of other assets into a new company that will have revenue of $10 billion and earnings of about $2.8 billion. The 20th Century Fox lot in Century City will also remain with the spinoff Fox company.” So that means ESPN, ABC News, ABC, etc. stay with Disney.

So why make the purchase? First, Fox was going to be for sale no matter what. It was in debt and the Murdochs were no longer interested in managing a media conglomerate of Fox’s size. Meanwhile, Disney, reading the landscape correctly that content providers will be king in the decades to come, needed more content. They’re looking to increase their streaming footprint, and now they have 20th Century Fox movies and TV shows to provide both in terms of a back catalog and in terms of future projects. Additionally, Disney has acquired Fox’s share in Hulu, which makes Disney the majority owner of Hulu. This could set Hulu on the path to seriously challenging Netflix’s supremacy in the streaming space.

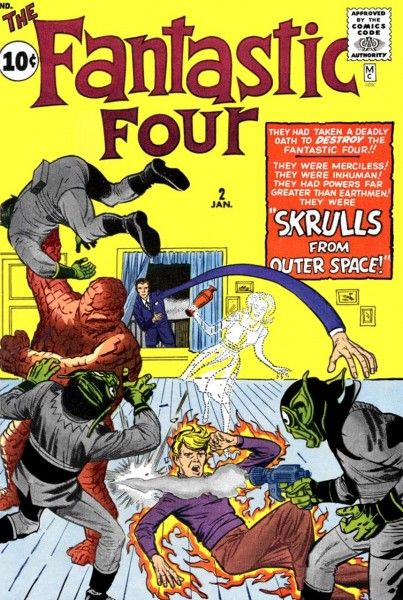

For the fanboys, yes, it also means that Disney would own the X-Men and Fantastic Four, thus bringing both into the Marvel Cinematic Universe. Again, it will take about 18 months for the deal to get approved by the government and Marvel Studios already has their slate laid out to the end of Phase 3. Additionally, based on the reaction to X-Men: Dark Phoenix or New Mutants, it’s possible that Disney may want to keep Fox’s “continuity doesn’t matter” strategy intact. That being said, I wouldn’t be surprised if Doctor Doom became the new big bad of the MCU following the events of Avengers 4.

Additionally, Disney would now own all the Star Wars movies. They previously lacked the rights to A New Hope, but now the studio would own all the movies and could conceivably release non-special editions or 4K versions of every movie. Obviously, Star Wars is big business for Disney and they’re not going to let any part of the property go without maximizing its profits.

And yet despite these nice concessions, it all feels like a major loss for consumers. Hundreds of employees will probably lose their jobs due to redundancies, uber-wealthy people will become even wealthier, and now there’s one less studio where people can pitch competing properties. We don’t know yet know how Disney will manage Fox. Will Fox still be able to make R-rated movies? What happens to Fox Searchlight? Some may give Disney the benefit of the doubt and assume everything will be fine, they’ll do whatever they can to maximize profits, etc. But the fact of the matter is that corporate consolidation rarely benefits consumers.

There’s also the Fox side of the equation, and it will be interesting to see what the Murdochs do with Fox broadcasting (chances are it will be filled with reality TV and conservative-leaning news programs) or how they proceed from here. Additionally, there are consequences we just can’t know about a deal of this size, and we won’t have a better lay of the land for months to come.